irrevocable trust capital gains tax rate 2020

At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. Over 2600 but not over 9450.

Tax Related Estate Planning Lee Kiefer Park

The 0 and 15 rates continue to apply to amounts below certain threshold amounts.

. 2 Rate for taxpayers in the top income tax bracket. 0 2650. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041 tax return.

For trusts in 2022 there are three long-term capital. 0 15 or 20. 2021 Long-Term Capital Gains Trust Tax Rates.

10 percent of taxable income. The trustees take the losses away from the gains leaving no. Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates.

IRS Form 1041 gives instructions on how to file. Grantor Trusts 0 - 2600 0 10 0 2600 9450 260 24 2600 9450 12950 1904 35 9450 12950 3129 37 12950 The tax rate on long-term capital gains and qualified dividends for individuals estates and grantor trusts is also based on a bracketed system. Over 9450 but not over 12950.

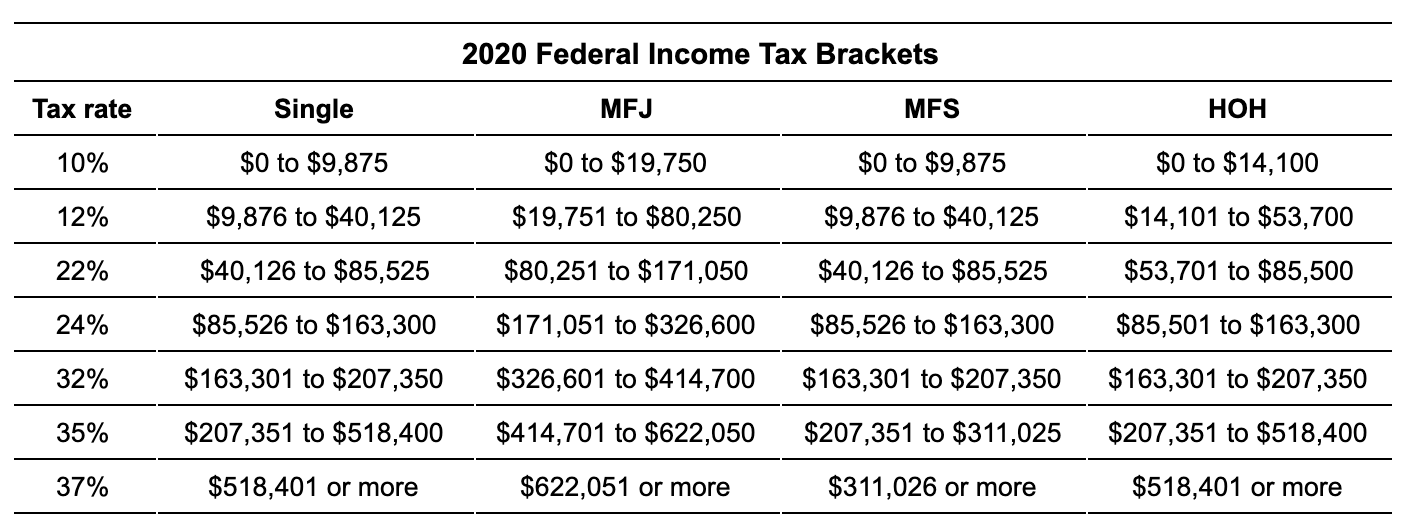

260 plus 24 percent of the excess over 2600. CAPITAL GAINS 2020 2019 Holding Period Top Capital Gains Rate 2020 2019 12 months or less 1 371 37 More than 12 months 1220 20 12 Depreciation recapture on real estate 25 25 Collectibles and certain small business stock 28 28 1 Capital gain rates may be subject to an additional 38 Medicare tax. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income.

Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. For 2020 trusts pay tax at the maximum income tax rate when taxable income exceeds 12950. The 0 rate applies to amounts up to 2650.

Given that California taxes net capital gains at the same rates as ordinary incomewith a maximum rate of 123 percent or 133 percent with respect to taxable income in excess of 1000000an otherwise out-of-state trust may have significant California income tax. In comparison a single individual taxpayer is subject to the highest tax rate at 518400 of taxable income and the NIIT applies modified adjusted gross income in. For example if a trust has taxable income of 13000 in 2019 and then subsequently makes a distribution of 13000 to a beneficiary within the 65-day window in 2020 the trust could potentially reduce its taxable income to zero for 2019 saving approximately 3150 in taxes the 2019 trust tax rate is 37 for income above 12750.

In addition the same threshold applies to the additional 38 percent net investment income tax. If taxable income is. Moreover the top tax rate of 20 for preferential income such as long-term capital gains LTCG and qualified dividends begins after reaching a threshold of 13250 for trusts where the threshold for single filers is over 445850 of income and for married filing jointly over 501600 of income.

The rate remains 40 percent. Capital gains and qualified dividends. For tax year 2020 the 20 rate applies to amounts above 13150.

Qualified dividends and capital gains on assets held for more than 12 months are taxed at a lower rate called the long-term capital gains rate. It applies to income of 13050 or more for deaths that occurred in 2021. Long-term capital gains are usually subject to one of three tax rates.

Value of Irrevocable Trusts There are a number of different situations that can call for the creation of an irrevocable trust and one of them is the special needs planning. In 2020 to 2021 a trust has capital gains of 12000 and allowable losses of 15000. Long-Term Capital Gain Tax Rate Single Married Filing Joint.

However long term capital gain generated by a trust still maxes out at 20 plus the 38 when taxable trust income exceeds 13050. As the tables below for the 2019 and 2020 tax years show your overall taxable income determines which of. Trust tax rates are very high as you can see here.

The tax rate schedule for estates and trusts in 2020 is as follows. It continues to be important to obtain date of death values to support the step up in basis which will reduce the capital gains realized during the trust or estate administration. From earnings per share of 488 in 2018 the companys EPS dropped to minus 525 in.

The tax rate works out to be 3146 plus 37 of income over 13050. 2022 Long-Term Capital Gains Trust Tax Rates. Table of Current Income Tax Rates for Estates and Trusts 202 1.

A 20 rate applies to adjusted net capital gain that if it were ordinary income would be subject to the 37 income tax rate Investment Income Surtax In 2021 a 38 surtax applies to the lesser of 1 undistributed net investment income NII or 2 any excess of adjusted gross income over 13050. The maximum tax rate for long-term capital gains and qualified dividends is 20. With a simple irrevocable trust all the profits would be distributed to the beneficiary annually and they would be taxed at the beneficiarys regular income tax rate.

Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits on the sale of a home. The highest trust and estate tax rate is 37.

2021 Year End Tax Planning For Individuals Somerset Cpas And Advisors

Biden Tax Plan And 2020 Year End Planning Opportunities

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

New York State Enacts Tax Increases In Budget Grant Thornton

Does A Trust Pay Taxes Estate Planning Checklist Estate Planning Paying Taxes

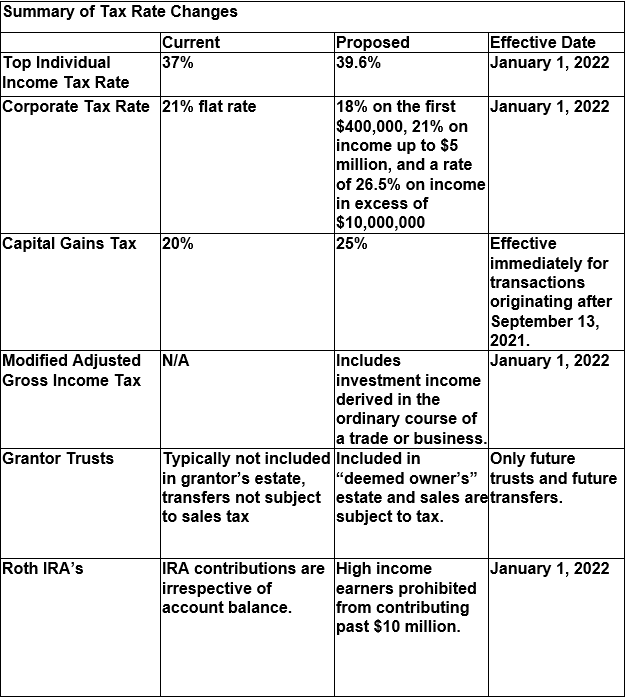

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

Distributable Net Income Tax Rules For Bypass Trusts

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

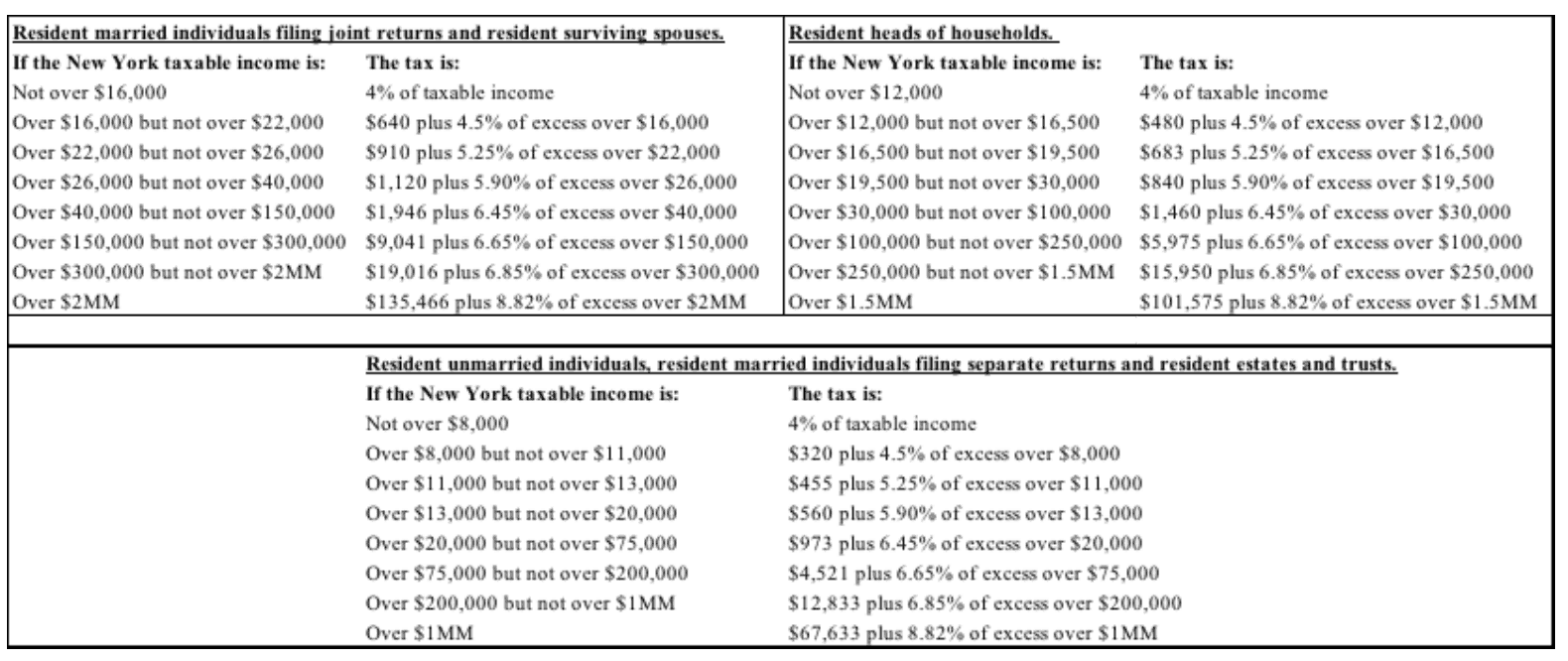

New York Resident Trust Vs An Individual Tax Rate

Historical Estate Tax Exemption Amounts And Tax Rates 2022

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Maximizing Nua Benefits For Employee Stock Ownership Plans

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What Is The U S Estate Tax Rate Asena Advisors

2021 Year End Tax Planning For Individuals Somerset Cpas And Advisors

Summer 2020 Tax Tips Storen Financial

Individual Tax Planning Moves That Will Help Lower Your Tax Bill Tax Tips